Lessons I Learned From Tips About How To Check Status Of An Amended Tax Return

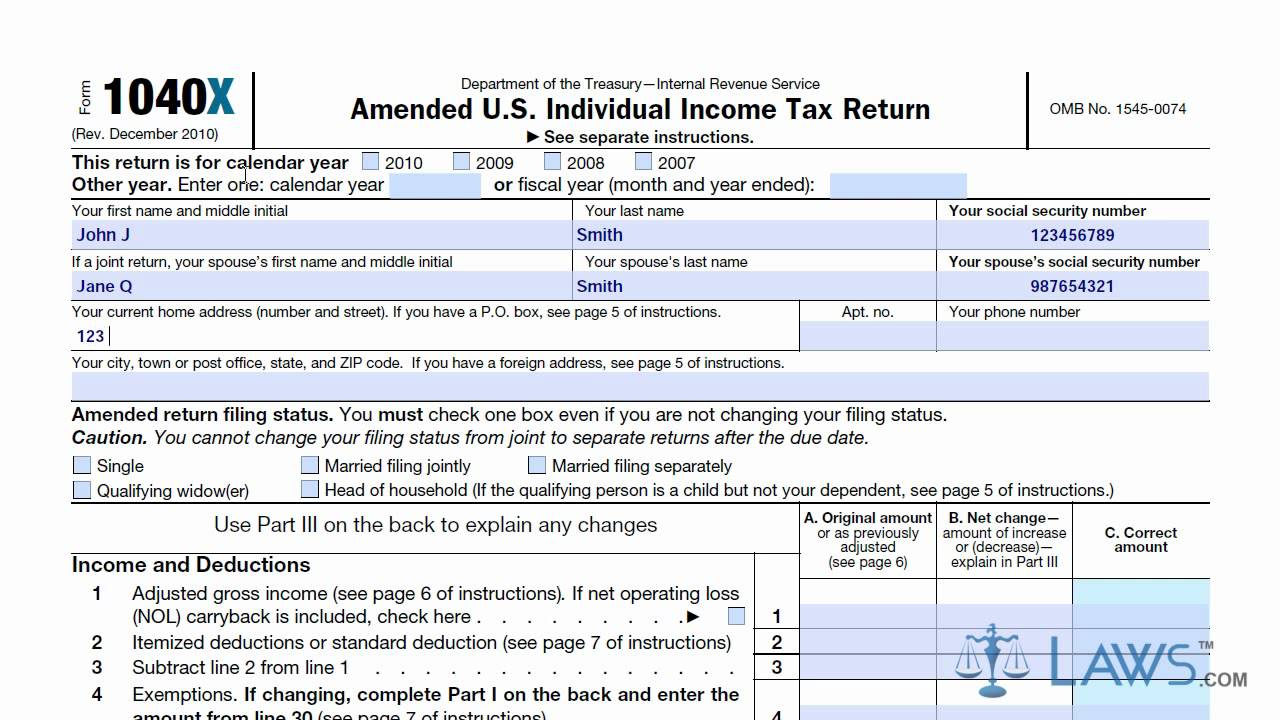

Individual income tax return, for this year and up to three prior years.

How to check status of an amended tax return. You received a notice of tax return change. Is interest paid on amended refunds? Individual income tax return using the where’s my amended return?

Individual income tax return using the where’s my amended. How to check the status of an amended tax return? How to check for your amended return?

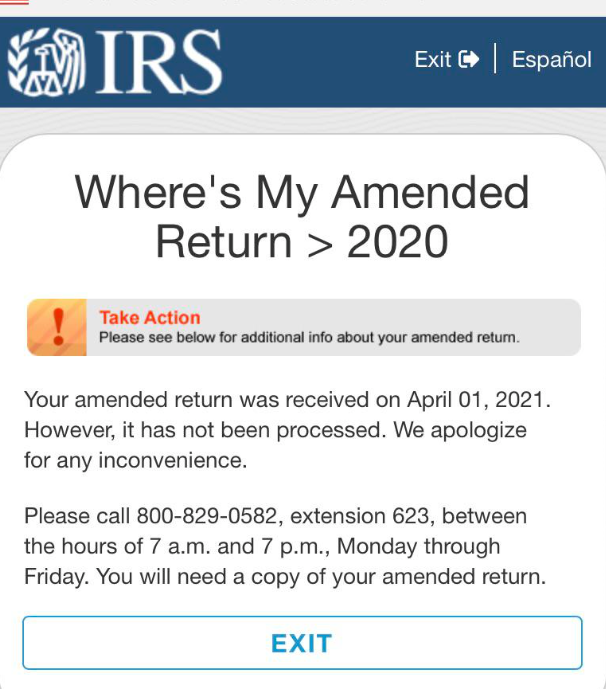

Once you have the above information handy, head to the irs’ where’s my amended return tool and follow the. Contact us by chat, phone, or mail to check the status of your amended return. If you were expecting a federal tax refund and did not receive it, check the irs' where’s my refund page.

File your taxes for free; Check the status of your amended return. Individual income tax return using the.

Get an identity protection pin (ip pin) Apply for an employer id number (ein) check your amended return status; You may not have to.

You'll need to enter your social security number, filing status, and the. The status of an amended return can also be determined approximately 3 weeks after it has been mailed by calling the irs where's my amended return line at 866.464.2050. Individual income tax return using the where's my amended return?