Beautiful Work Tips About How To Sell Treasuries

Here, your bid will only be accepted if it is less than or equal to the rate set by the auction.

How to sell treasuries. Treasury and savings bonds may be bought and sold through an account at a brokerage firm, or by dealing directly with the u.s. Submit a bid in treasurydirect the bid submission process is completely online. Compare the best online brokers companycategory investopedia.

“the bank of england, in line with its financial stability objective, carefully monitors financial markets and any potential risk to the flow of. When the bill matures you automatically receive. Follow the prompts to specify the security.

Treasuries can be held until they mature or sold before that time. The teller will have this information. Investors who hold a bond to maturity (when it becomes due) get back the face value or par value of the bond.

Separate trading of registered interest and principal of securities (strips): Login to your account and click the buy direct® tab. However, not every maturity term for each.

But investors who sell a bond before it matures may get a far different. The treasury will then mail you a check for the proceeds. You can sell back your i bonds through the federal government’s treasurydirect site or by snail mail via its treasury retail securities services.

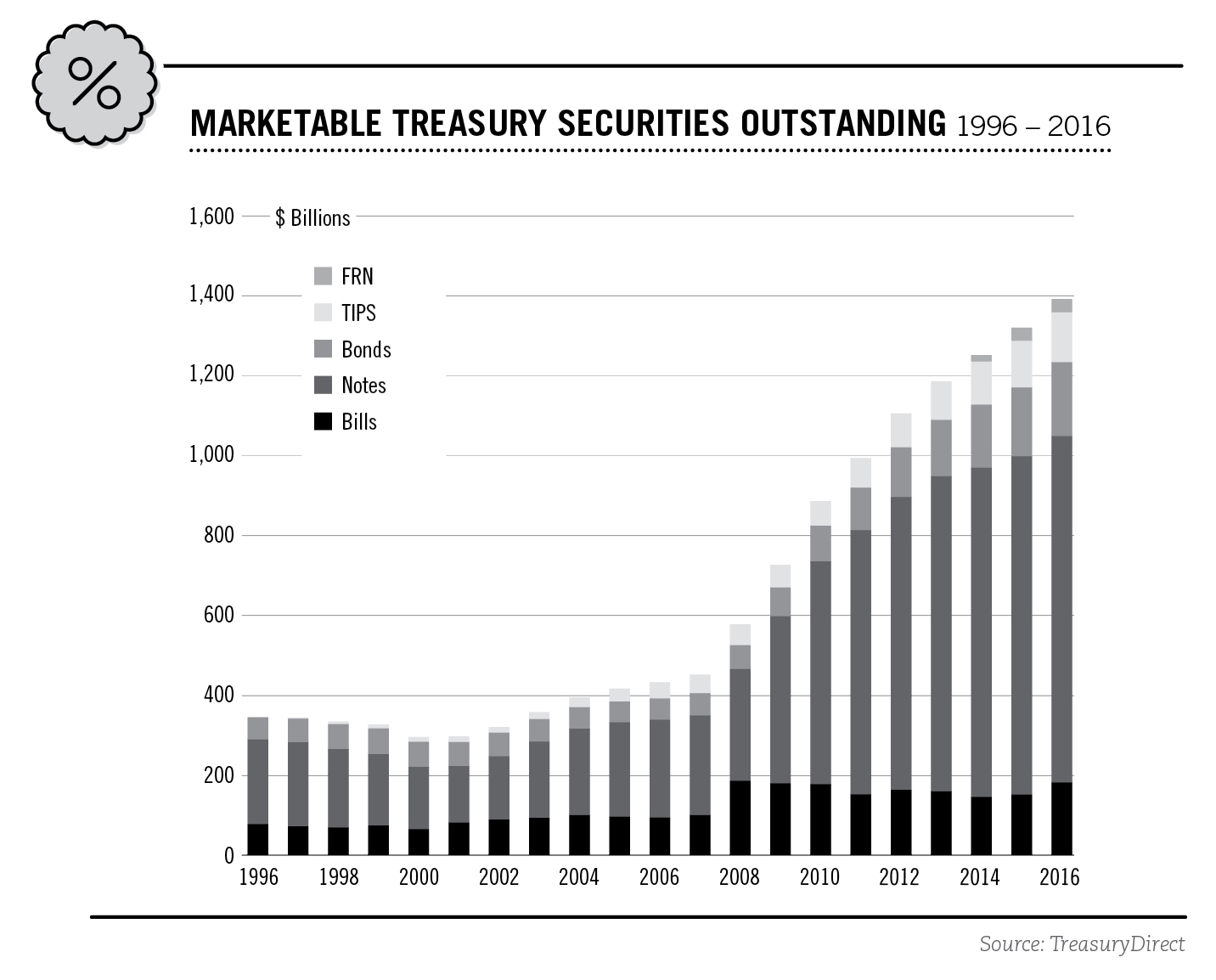

You can also purchase put options on specific treasuries, which affords you the opportunity to sell at a specified price before the expiration date. Auction purchase of treasury securities all three types of treasury securities can be purchased online at auction in $100 increments; Mail the signed bonds to the treasury retail securities site for your region.

/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)