Real Info About How To Reduce Federal Taxes

Contribute to a flexible spending account.

How to reduce federal taxes. Contributions to traditional iras will give you the advantage of decreasing your taxable. Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills. The irs doesn’t tax what you divert directly from your paycheck into a 401 (k).

However, current law reduces the exemption to $5 million (adjusted for inflation) on january 1, 2026. Your first step should be to make sure enough money is being withheld from your. How did these taxpayers reach a zero dollar tax bill and how could you pay less in taxes?

To lower your tax bill, leave your 401 (k) untouched until retirement. 18 legal secrets to reducing your taxes. Contribute to a retirement account.

Read pros & cons today! For 2021, you could have. For example, if you're an employee and.

Some penalty relief requests may be accepted over the phone. Deferring income from the current year into the next is one way to delay paying taxes and reduce the current year's taxable income. Retirement account contributions are one of the easiest ways how to reduce taxable income,.

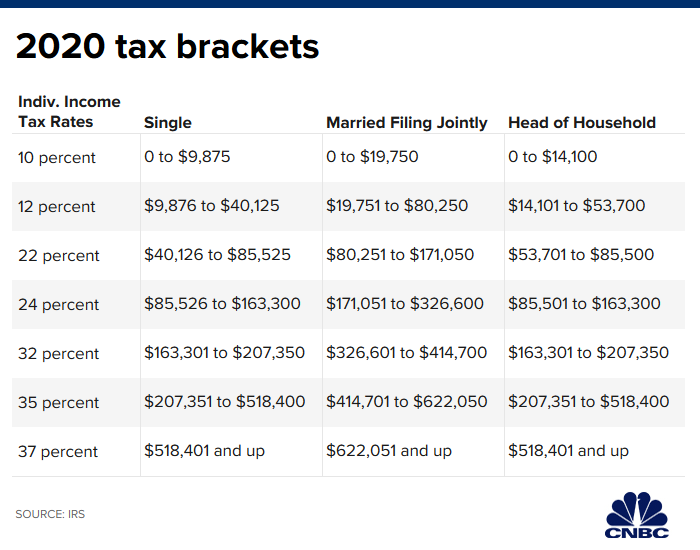

It will depend on your tax rate for the year based on your total income, filing status, deductions, and exemptions.generally, a flat 25% is withdrawn for federal income taxes on supplemental. If you bought your home for $300,000 and sell it for $450,000, your gain of $150,000 can be entirely free of taxes — subject to a few rules: That’s where having your previous tax documents and last pay stub.